The Reading Post accepts Letters to the Editor. All letters must be signed. The Reading Post reserves the right to edit or not publish any letters received. Letters do not represent the views or opinions of the Post. editor@thereadingpost.com

On October 24th, our Select Board will decide on the “split rate,” or rather the amount residential and commercial properties will be taxed. The tax rate will typically look like ~$13 per $1000 of assessed value. I wanted to examine what Reading’s tax rate has been historically, the comparison of commercial to residential, and in relation to our neighboring communities.

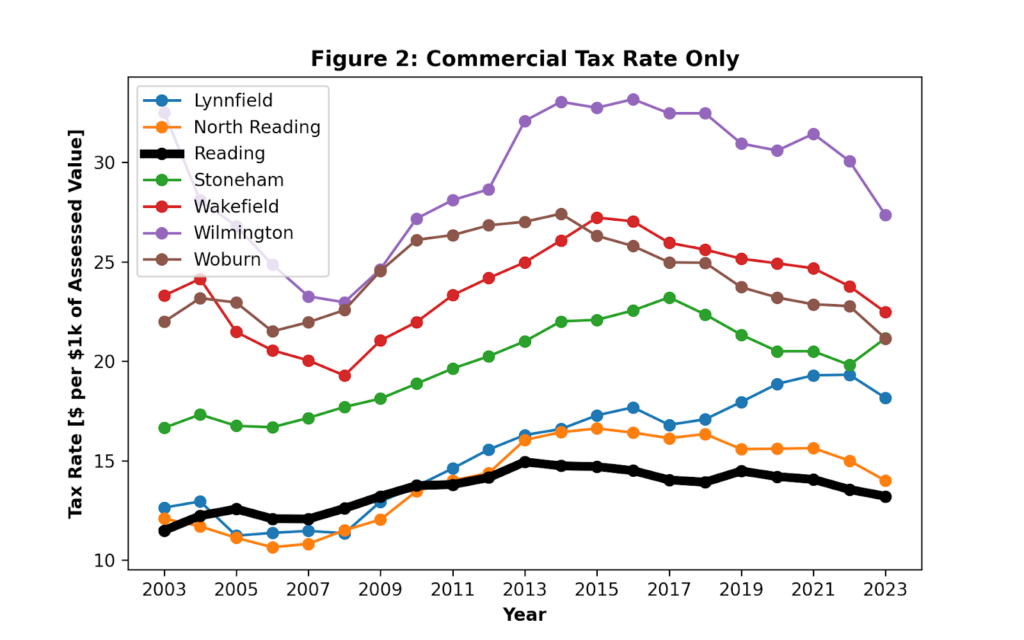

Figure 1 shows that among neighboring towns, Reading has the second highest residential tax rate, and has for over a decade. I am not complaining. I appreciate our wonderful town-funded services, like schools, public safety, and roads. Figure 2 shows that Reading has the lowest commercial tax rate of neighboring towns, and has for the last decade. The only other town that is comparable is North Reading. Other neighbors — Lynnfield, Stoneham, Woburn, and Wakefield — have a commercial tax rate that is about 35-70% higher. Wilmington comes in hot, with almost twice Reading’s commercial tax rate.

Besides Reading and North Reading, other towns have a split rate between 1.5 and 1.75. Reading has multiple options for adjusting its split rate: 1) choose 1.1 so that businesses have no additional tax burden, 2) set it to 1.15 so that residential and commercial tax burden increase is equal, 3) set it to 1.5 to match the rate of our neighbors, or 4) fall somewhere in between. But regardless of the set rate, Reading has been historically good to businesses in regard to split rate. And it would appear that no matter what the Select Board decides on October 24, Reading will continue to be favorable to businesses with the split rate, relative to other towns.

Gena Pilyavsky

Harriman Aveune