Balanced, responsible, and forward-looking spending plan aims to make Massachusetts more affordable and improve quality of life through education, infrastructure and housing investments

Governor also filed an Executive Order creating a Transportation Funding Task Force to make recommendations for a long-term, sustainable transportation finance plan

BOSTON – The Healey-Driscoll Administration today filed its Fiscal Year 2025 (FY25) budget recommendation, a $56.1 billion plan that responsibly controls spending growth while investing in education, infrastructure and housing to make Massachusetts more affordable and improve quality of life.

“Our Fiscal Year 2025 budget proposal is balanced, responsible and forward-looking. It protects taxpayer dollars while also making crucial investments to lower costs for people and improve quality of life,” said Governor Maura Healey. “Together, we can make child care more affordable and accessible for families, ensure every student is receiving a high-quality education, and improve our public transportation, roads and bridges. We thank the Legislature for their consideration of our proposal and look forward to our partnership throughout the budget process.”

“As a former mayor, and someone who has traveled around the state listening to our local officials, I’m proud of the way that this budget proposal responds to local needs,” said Lieutenant Governor Kim Driscoll. “We’re fully funding the Student Opportunity Act to make sure our K-12 schools have equitable access to the resources their students and educators need. We’re also increasing the amount of local aid going to cities and towns and boosting Chapter 90 funding to improve roads and bridges, particularly in rural communities.”

This budget, filed as House 2, fully funds the fourth year of the Student Opportunity Act, increases local aid, and pays for the next phase in of the historic tax cuts enacted last year that will begin delivering savings to Massachusetts residents this Spring.

Additionally, the budget proposes to invest $1.3 billion in revenue generated by the voter-approved Fair Share surtax to support transformative investments in education and transportation. These include the administration’s new Gateway to Pre-K initiative, which puts Massachusetts on the path to universal Pre-K access in Gateway Cities by 2026 and would expand child care financial assistance to thousands more families. It also includes the new Literacy Launch program, a transformative plan to improve early literacy education and ensure students receive the highest quality, evidence-based reading instruction available.

The administration also proposed utilizing Fair Share funds to increase funding for roads and bridges, including dedicated road aid for rural communities, implement a low-income fares program at the MBTA, and make a new investment of $250 million in transportation that will leverage $1.1 billion in borrowing over the next five years to tackle long overdue deferred maintenance. House 2 also follows through on Governor Healey’s commitment to propose doubling operating assistance for the MBTA.

House 2 maintains $475 million in Commonwealth Cares for Children (C3) grants, fully supports universal school meals, continues the MassReconnect program to provide no-cost community college for students aged 25 and older, and maintains 1 percent of total spending for the Executive Office of Energy and Environmental Affairs.

House 2 also proposes to create a new Disaster Relief and Resiliency Fund to better set up Massachusetts to be able to respond quickly to natural disasters, such as the flooding experienced over the past year. This fund would be capitalized with 10 percent of annual excess capital gains, in addition to public and/or private sources, federal grants, settlements, repayments, or reimbursements available for the purpose of delivering aid.

Transportation Funding Task Force

Alongside this budget, Governor Healey signed an executive order to create a new Transportation Funding Task Force. This Task Force will be composed of public and private-sector leaders, representing communities of all sizes across Massachusetts, that will spend the next 12 months examining the state’s transportation system and developing recommendations for a long-term, sustainable transportation finance plan that can support safely and reliably support road, rail and transit systems throughout our state.

Supplemental Budget

Governor Healey also filed alongside House 2 a supplemental budget to cover known deficiencies in the emergency assistance shelter system for FY24 and exposures in FY25. The legislation will be consistent with the blueprint already published proposing to move the balance of the Transitional Escrow Fund to a new fund that can be used to support housing development, as well as shelter costs for the current fiscal year and into FY25.

House 2 Overview

House 2 proposes $56.1 billion in gross spending, excluding Fair Share surtax and Medical Assistance Trust Fund spending, which represents 2.9 percent spending growth over the Fiscal Year 2024 (FY24) General Appropriations Act. This growth rate is below the current rate of inflation, based on the Consumer Price Index, and recognizes that the consensus revenue estimate of $40.2 billion was essentially flat from projections used to build the FY24 budget.

Additionally, this budget proposes to spend $1.3 billion from the Fair Share surtax on transportation and education in accordance with the consensus revenue estimate developed with legislative leaders and in keeping with the transparent mechanism establish in FY24 to track surtax spending.

In light of flat tax revenues, the House 2 recommendation utilizes a thoughtful combination of funding sources to ensure a responsibly balanced budget. Importantly, this budget does not raise broad-based taxes or utilize any funding from the Stabilization Fund balance, which has grown to a record high of over $8 billion and would continue to grow under House 2.

The consensus revenue estimate assumes $2 billion in total capital gains revenue. This blueprint allows for a portion of capital gains tax revenues above the statutory threshold, not to exceed $375 million, to be retained as a last resort to balance the budget and sustain essential programs.

In short, this budget continues needed investments in housing, education, transportation and healthcare, while being fiscally responsible in light of reduced revenue growth.

Spending is also supported by several one-time and new recurring resources, including a proposal to move the Lottery online and a tax amnesty program to help make sure Massachusetts can collect the taxes it’s owed.

The recommendation proposes to continue to use excess capital gains to build the Stabilization Fund balance, address pension and other post-employment benefit liabilities, and fund a new Disaster and Resiliency Trust Fund. The budget recommendation maintains the state’s commitment to fully fund its pension liability by 2036 with $4.5 billion in FY25, a $395 million increase over the FY24 contribution. Projected sales tax revenues will enable a $1.5 billion transfer to support the operations of the MBTA and $1.3 billion will be transferred to the Massachusetts School Building Authority to support school construction across the state. The budget also commits $27 million for the Workforce Training Fund to support the state’s workforce, competitiveness, and engine for growth.

“Recognizing our tightening fiscal environment, this budget responsibly controls spending and limits growths without jeopardizing the progress and impact we’ve been able to make over the past year working to make our education systems, tax code and housing more affordable for the people of Massachusetts,” said Secretary of Administration and Finance Matthew J. Gorzkowicz. “We have been able identify and invest in critical areas like child care and public transit while also putting the state on a path toward sustainability.”

Fair Share

For just the second year, House 2 proposes to use revenue generated from the 4 percent Fair Share surtax on income above $1 million to invest in education and transportation. The FY25 House 2 budget recommends $1.3 billion for programs ranging from financial aid for public higher education to implementing low-income fares at the MBTA – all focused on transformative investments for improving affordability, equity, and competitiveness across the state.

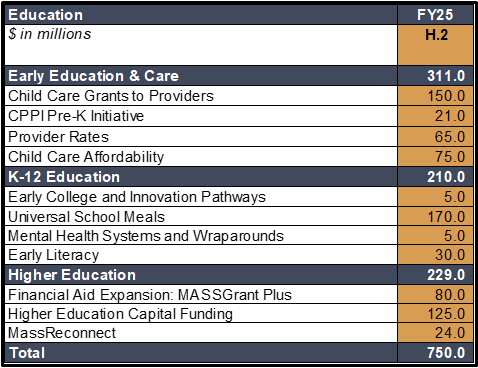

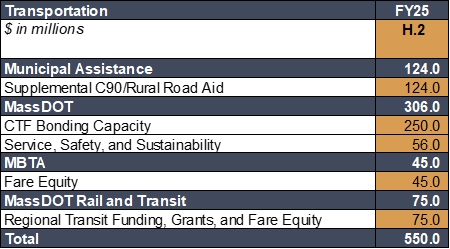

House 2 recommends the following investments across the two priorities:

Notably, in education, House 2 proposes to use $150 million to supplement spending in the operating budget to maintain $475 million for C3 grants to support and stabilize the early education and care system. Another $21 million for the Commonwealth Preschool Partnership Program will enable a $38.6 million total FY25 investment to put the state on a path to universal Pre-K starting with all Gateway Cities by 2026. Fair Share funds will also support $30 million for Literacy Launch to promote quality reading instruction for young learners and $75 million to expand access to child care financial assistance for families up to 85 percent of the state median income.

In transportation, a new investment of $250 million in the Commonwealth Transportation Fund will increase the borrowing capacity of the CTF by $1.1 billion over the next five year enabling the advancement of major infrastructure projects around the state. Fair Share spending will also support $124 million in supplemental Chapter 90 spending to cities and towns to support maintenance of local roads and sidewalks, including $24 million dedicated directly to rural communities. Another $45 million would enable the MBTA to implement a low-income fare relief system wide, and $15 million would go to support fare equity at Regional Transit Authorities.

Local Aid

The Healey-Driscoll Administration recognizes that the partnership between the state and its cities and towns is pivotal to building the communities in which people want to live, work, play, and stay.

The Fiscal Year 2025 budget proposal fully funds the fourth-year implementation of the SOA, dedicating $6.86 billion to Chapter 70 education aid. This is a $271 million, or 4 percent increase, over FY24. House 2 would guarantee a minimum aid increase of $30 per pupil.

House 2 also proposes to fund Unrestricted General Government Aid at $1.3 billion, a $38 million, or 3 percent, increase over Fiscal Year 2024, and fully funds the Special Education Circuit Breaker at $492.2 million. When combined with $75 million of supplemental funding from the Fiscal Year 2023 close-out budget that will be available across Fiscal Year 2024 and Fiscal Year 2025, $567 million in total Special Education Circuit Breaker funding would be available to meet all projected district claims and this reflects the full phase-in of out-of-district transportation cost reimbursement provided for in the SOA.

This budget also recommends an increase of $2.4 million, or 2 percent over Fiscal Year 2024, for regional school transportation reimbursements. Overall, Local Aid to cities and towns totals $8.7 billion, a $269.4 million, or 3 percent, increase, over Fiscal Year 2024.

Education

Early Education and Care

- $475 million for Commonwealth Cares for Children (C3) grants to providers to stabilize the early education and care system

- $20 million for provider rate increases above sustained FY24 increase

- $38.6 million for the Commonwealth Preschool Partnership Initiative

- $5 million for early childhood mental health supports, with an additional $5 million in Fair Share to be utilized across the Executive Office of Education

- $10 million for career pathways program for early educators

Higher Education

- $80 million to sustain the expansion of MASSGrant Plus and maintain FY24 financial aid expansion

- Covers tuition, fees, books, and supply costs for Pell Grant-eligible students and reduces out-of-pocket expenses for middle-income students ($73 K to $100 K AGI) by up to half

- $24 million for MassReconnect, an increase of $4 million

- $24.9 million for mental health supports

- $8.8 million for foster care financial aid and fee waiver programs to support over 1,400 Department of Children and Families eligible students attending private and public campuses

- $14 million for the Community College SUCCESS fund

- $125 million in Fair Share funding to support capital improvements across campuses, including lab and instructional facilities, infrastructure modernization, decarbonization, and critical repairs

Transportation

MassDOT

- $588 million for MassDOT operations including Highway, RMV, Rail and Transit, and Aeronautics

- $56 million for safety, service and sustainability programs

MBTA

- $314 million in direct operating support, doubling the $127 million in direct operating support in FY24 and maintaining $60 million for pay-go capital; This is in addition to $1.5 billion in projected sales tax revenue transfer

- $45 million for the FY25 implementation of Low Income Fare Relief

Regional Transit Authorities (RTAs)

- $94 million for RTA base funding

- $75 million in Fair Share funds to support operational improvements and expand access, including:

- $56 million for regional transit funding and grants

- $15 million for RTA fare equity programs

- $4 million for grants to expand mobility options

Economic Development

- $7.5 million for Small Business Technical Assistance Grants

- Launches a new Entrepreneur-In-Residence Program to help keep international graduates of Massachusetts colleges and universities in the state upon graduation

- Builds a Reciprocity Ombudsperson Unit at the Division of Occupational Licensure to guide those seeking licensure from other jurisdictions through the process in Massachusetts

- Creates technical assistance support for the Business Front Door, which aims to transform the way businesses interact with state government

- Funds capacity at the executive office to take the lead on priorities such as siting and permitting, technical assistance for businesses, and “Climatech”

- $10 million for the Massachusetts Life Science Center (MLSC)

- $8.5 million for initiatives at the Massachusetts Technology Collaborative to support workforce, manufacturing, cybersecurity, and the innovation economy

Housing and Homelessness

- $219 million for the Massachusetts Rental Voucher Program (MRVP), a 22 percent increase, to support over 10,000 voucher holders by the end of FY25

- $112 million for subsidies for Local Housing Authorities, including an increase for local tenant organizations to match the federal rate ($25/unit)

- $16.5 million for the Rental Subsidy Program for DMH clients, which will preserve 220 additional rental vouchers created in FY24

- $197.4 million for Residential Assistance for Families in Transition (RAFT), preserving a maximum benefit of $7,000 over 12 months

- $57.3 million for HomeBASE, maintaining a benefit level of $45,000 over 36 months to connect EA-eligible families with more permanent housing opportunities

- $3 million for Housing Assistance for Re-Entry Transition, providing transitional housing and rental vouchers to support adults exiting incarceration

- $325 million for Emergency Assistance Family Shelter (EA) program, with remaining need to be funded through accompanying supplemental budget

Climate and Environment

For the second year in a row, the Healey-Driscoll administration’s FY25 budget would guarantee that climate and environmental programing through the Executive Office of Energy and Environmental Affairs is funded at 1 percent of the overall budget – $572.1 million. This represents a $14.2 million, or 3 percent, increase over FY24, including $5.6 million to establish new technical assistance programs for culverts, small bridges, and dams, as well as funding for a new carbon sequestration program.

- $25 million to support Food Security Infrastructure Grants

- $30 million for the Massachusetts Clean Energy Center to support workforce training programs in the clean energy industry, clean transportation adoption, and an energy retrofit pilot program

- $4.8 million for a decarbonization clearinghouse (one-stop shop for energy efficiency, electrification, and storage)

- $1.7 million for sampling at landfills and water facilities for PFAS

- $1.5 million to expand air quality monitoring statewide

- $1.5 million for climate and drought resilience through the Dept. of Environmental Protection

Labor and Workforce Development

- $15.7 million for Summer Jobs Program for At-Risk Youth (Youthworks) to subsidize wages and facilitate career development of at-risk youth between the ages of 14 and 25

- $10.4 million for Career Technical Institutes (CTIs), which aim to close skills training gaps by expanding access to vocational education, across EOL and Education

- $10 million for MassHire Career Centers to provide regional workforce training and employee placement services across 29 locations

- $3.8 million for the Registered Apprenticeship Program to fund approximately 1,000 placements for registered apprentices in FY25

Health and Human Services

- $390 million for Chapter 257 provider rate increases benchmarked to the 53% of BLS salaries and $249.9 million to annualize FY24 rate increases

- $112.9 million for collective bargaining increases and $75 M to support direct care staffing needs shifted from off-budget reserve

- $90.3 million to support and Turning 22 classes

- $44.2 million to meet projected need in TAFDC and EAEDC benefits

- $17 million increase for behavioral health initiatives at DMH to expand inpatient and community capacity

- $10 million for the development of intensive care program models for high-need youth

- $5 million for reducing and eliminating copays for low-income Home Care clients at EOEA

- $4.9 million for certificate programs, recruitment bonuses, and expanded access to licensing to expand the CNA workforce

- $3.1 million for postpartum care services for DCF clients with substance use disorders

- $2.5 million to continue new home and community-based service programs to help DDS clients remain in their homes

- $2.1 million for youth delinquency prevention through the Massachusetts Youth Diversion Program (MYDP) at DYS

MassHealth

MassHealth, the Commonwealth’s Medicaid and Children’s Health Insurance Program (CHIP), provides coverage of health care and related critical services to over 2 million members, including over 40 percent of Massachusetts children and over 60 percent of Massachusetts residents living in nursing facilities. MassHealth maintains affordable, equitable, comprehensive health care coverage for members.

In Fiscal Year 2025, MassHealth will continue to ensure access to high-quality services while managing the loss of ~$1 billion of annual federal revenue during the pandemic and significant health care cost growth over the past two years.

House 2 recommends $20.3 billion gross/$8.2 billion net for MassHealth, an increase of $730 million gross/$440 million net above estimated Fiscal Year 2024 spending. These growth figures assume the implementation of substantial savings initiatives, including enhanced program integrity efforts, additional federal revenue streams, and targeted reductions in spending.

Despite these fiscal headwinds, the budget proposal proposes investments that advance MassHealth’s priorities, which are: (1) advancing health equity, (2) simplifying member experience and improving customer service, (3) strengthening behavioral health and primary care, and (4) promoting member independence.

MassHealth targeted investments to improve access to care, include:

- ~$70 million in targeted rate investments that address workforce challenges across community-based nursing and direct care workers.

- $5 million to improve access to wheelchair repair services.

- ~$60 million in rate investments in behavioral health, primary care and maternity care

- $10 million of infrastructure funding for correctional partners in advance of implementing MassHealth coverage 90 days before release from jail or prison settings.

Public Safety

- $35 million to enhance equity and eliminate barriers to communication through implementing No Cost Calls across all correctional facilities, including those run by county sheriff departments

- $16 million in operating budget savings through the closure of MCI Concord; Incarcerated individuals and staff members transferred to nearby facilities by July 1, 2024

- $2 million for the State Police Cadet Program; $10.3 million for 91st State Police Recruit Training Troop.

- $5.6 million for State Police body-worn cameras for all sworn Troopers

- $10.7 million to maintain support for reentry initiatives across DOC and EPS

- $2 million to sustain the Safe Neighborhood Initiative

Serving Our Veterans

- Fully covers the cost of implementing the HERO Act

- $4.3 million to increase Ch.115 annuity payments from $2,000 to $2,250

- $1.0 million revenue reduction to waive veteran license plate fees

- Maintains support for the Commonwealth’s veterans and makes critical staffing and infrastructure investments at the Chelsea and Holyoke Soldiers’ Homes

- Prepares for the opening of new Soldiers’ Homes facilities:

Technology and Cybersecurity

- Creates the Digital Accessibility and Equity Governance Board, and the position of Chief IT Accessibility Officer (CIAO)

- $600,000 to support the AskMA mass.gov chatbot

- $4.2 million for technology modernization and hardware maintenance contracts

- $700,000 for advanced threat protection software and other upgrades

To access the Governor’s filing letter, budget message, budget briefs, and specific account information click here.